Financial industry is susceptible to getting embroiled in financial crimes of their customers by facilitating the movement of their illegal funds. They will be held accountable for being accomplice in ignoring the financial misconduct of their clients by the international regulatory authorities and law enforcement agencies. Therefore, the financial firms and big corporations have mandated regulatory guidelines such as PEP list screening at the domestic, regional and international level for which they are bound to comply with.

Understanding Politically Exposed Persons (PEPs)

The Politically Exposed Persons (PEP) Screening before providing any financial services to a client or initiating any business relationship is an essential process that helps prevent financial crimes. Politically Exposed Persons as explained in the Recommendation 12 of the Financial Action Task Force (FATF) are individuals who have huge social and political influence owing to their powerful public office and circle of influence. People close to Politically Exposed Persons such as their close business partners or family relatives or anyone close to them are also categorized as Politically Exposed Persons.

Why Are PEP Screening Measures Indispensable?

For the financial institutions and big businesses, engaging in a business relationship with a client who hold a considerable social and political influence, and fits in the category of Politically Exposed Persons in line with regulatory guidelines issued by the law enforcement agencies and international regulatory authorities ike Financial Action Task Force (FATF), comes with enormous risks. Therefore, a risk based approach is recommended while conducting a business with any client to avoid the enormous risk facilitating their criminal activities and facing legal penalties for that.

Politically Exposed Persons are usually more inclined to abuse their enormous influence and commit financial crimes like money laundering, embezzlement of state funds, bribery, corporate frauds, corruption, terrorist financing and beyond. These financial crimes present acute global challenges and costs the world economy hundreds of billions and trillions of global GDP every year. A single financial crime like money laundering costs the world economy $2 trillion per annum. This figure would most likely be higher in real terms. This staggering amount lost in financial crimes adversely affects the economies of all countries. Not only this, it boosts global criminal activity and facilitates human trafficking, drug trafficking, funds the wars and terrorist organizations and contributes to political corruption.

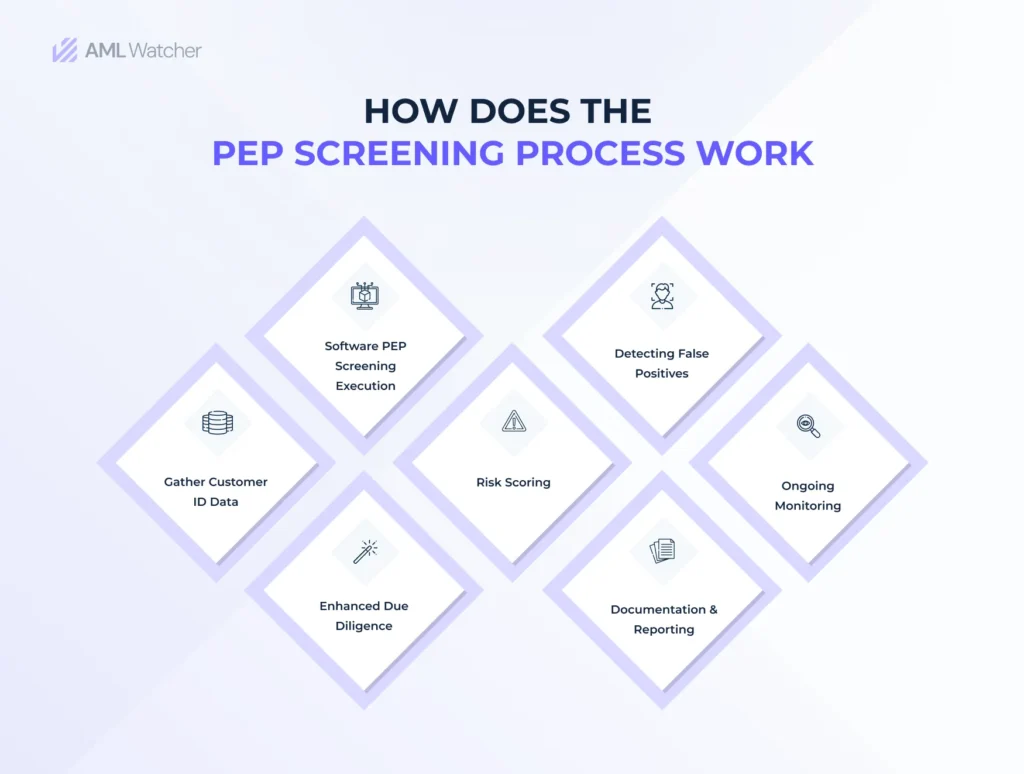

How PEP Screening Works?

PEP check is a part of the Anti-Money Laundering and Know Your Customer (AML/KYC) regulatory requirements. The process starts off by identifying a potential client and conducting customer due diligence (CDD) during the initial registration process. The primary purpose of conducting PEP screening is to evaluate the risk levels of initiating a business relationship or providing financial services to the potential PEP client. Their PEP status will be determined and their risk profile will be constructed for further client analysis. A financial firm may choose to establish a business relationship with a high-risk PEP client. However, to mitigate the risks of financial crimes by the PEP clients, additional precautionary measures like Enhanced Due Diligence (EDD) will be organized to have periodic surveillance done in order to monitor the financial activities of PEP clients.

Who Publishes PEP Lists?

Various government agencies and regulatory organizations publish and maintain Politically Exposed Persons (PEP) lists. These lists may comprise data on powerful public figures such as world leaders, senior military officers, popular politicians, influential religious leaders like the Pope, or Dalai Lama, top executives of big businesses like Apple, Google, powerful public officials, and many more. Financial firms are obligated to screen their potential clients against such PEP lists maintained by regulatory authorities and government agencies, and determine their PEP status. The PEP status is determined based on the circle of influence a client may have in the political and social circles of society.

Once the PEP status is clear and sorted out, their risk profile will be constructed. If the PEP client turns out to be a high risk customer, then the decision to provide financial services or engage in business relationship with them depends on the senior executives.

What Could Be The Consequences of Non-Compliance?

Financial services sector including banking sector, investment firms, hedge funds, insurance companies, credit unions and others are all responsible to comply with regulatory guidelines or they end up facing the consequences of non compliance. Legal repercussions may include costly lawsuits, hefty fines and even imprisonments of accomplices like top executives. In some extreme cases, financial institutions also had to face suspension of their licenses. Damage to a firm’s reputation is another undesired outcome of non compliance. Therefore, financial firms must prioritize employing PEP compliance programs that have effective PEP screening software to save themselves from costly risk.